Florida Realtors News

News Archive

A 30-year, fixed-rate loan averaged 7.09% this week, its highest level since it was 7.13% in April 2002. It also exceeds a high of 7.08% hit last fall.

A resident told to take down a political candidate sign suspects it’s due to the candidate more than the sign. Do political signs have any constitutional protection?

Christina Pappas, 2022 president, is the 2023 Realtor of the Year. All award winners were recognized Thurs. at the annual convention’s in-person Awards Luncheon.

The money will go to public housing agencies that assist homeless vets. HUD estimates that the money will help move 7,500 more former service members off the streets.

Single-family housing permits – a sign of future construction activity – increased marginally by 0.6%, though overall permits dropped 13.9% as multifamily slows.

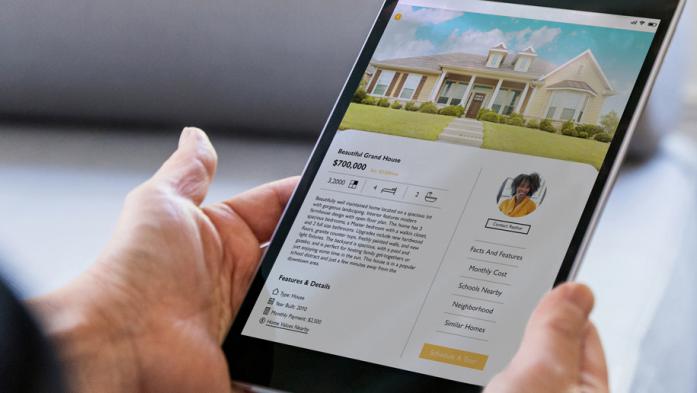

An Orlando team leader uses professional RE writers for his website and offers expansive content – blogs plus articles that complement his listings.

“Livability” is subjective, but an exhaustive study attempted to rank states based on how happy they’ll make residents. Fla. was No. 6 – but No. 1 in some categories.

In 2022, more homeowners fought rising inflation by tapping into home equity. In two years, equity lines of credit originations rose 41% as equity loans rose 166%.

NAHB’s Aug. index fell 6 points to 50 – the break-even point between optimism and pessimism – based on higher mortgage rates and increased construction costs.

A comparison of teacher salaries to home values within 20 minutes of work found a high of 18% affordable in Fort Lauderdale and Jacksonville but only 4% in Miami.