Florida Realtors News

News Archive

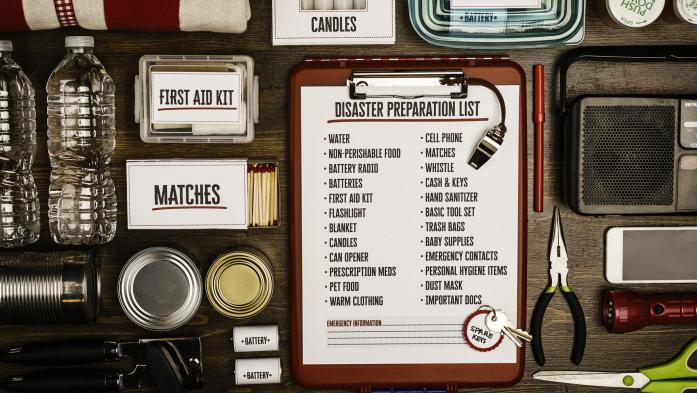

It includes a disaster-preparedness holiday through June 9 eliminating sales taxes on some storm supplies and other goods; and a reduction in the commercial-lease tax.

Optimize your RE website for search engines by integrating keyword phrases into content, metadata and titles – and also make sure your website is mobile-friendly.

In 1Q 2023, 42.9% of sellers made a buyer concession; in 1Q 2022, it was 25.5%. Some do it to keep a transaction moving forward, others to match homebuilders’ freebies.

While the number of homes didn’t change, it varied by region. Of the four included in NAR’s report, pending sales fell only in the Northeast but rose everywhere else.

Wish you could tell an AI tool to independently handle meeting requests, track conversion rates, send emails and schedule your social media posts? Well, you can.

A broker’s branding sells your broker’s services. A personal brand sells you. It can differentiate you from other agents and boost your name within your market niche.

A pilot program found high levels of distress among construction workers – but many don’t want to talk about mental health, a challenge that’s hard to overcome.

The Florida CCIM Chapter president says “advanced commercial real estate education is a prime focus for CCIM,” and he’s proud that focus was “recognized by our colleagues.”

Inflation and higher interest rates are taking a toll. Many are cutting back on nonessential items, such as dining out, and using credit cards for must-have purchases.

Fla. lawmakers created six sales tax “holidays” in 2023, with expanded timelines and products. Once the bill is signed, the first hurricane holiday starts Sat.