Florida Realtors News

News Archive

FHA’s foreclosure-prevention options don’t work as well thanks to higher interest rates, so it’s taking comments about a proposed “Payment Supplement Partial Claim.”

The worst time to discover you have less insurance coverage than you thought? The day after a hurricane. The 2023 season starts today and runs through Nov. 30.

Investor purchases dropped almost by half year-to-year in the first quarter. In Fla., it ranged from a 56.6% decline in Jacksonville to 28.8% in West Palm Beach.

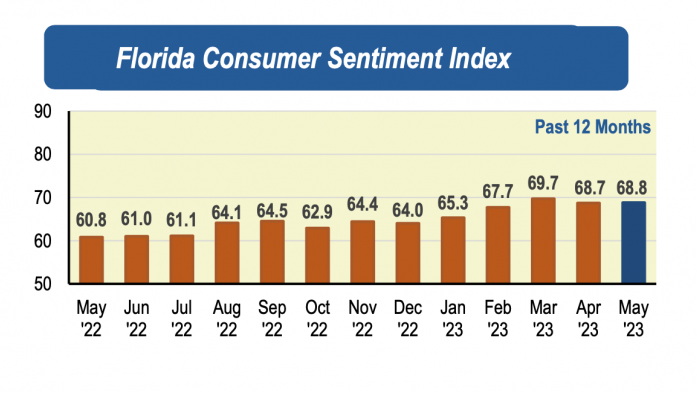

UF: After a drop in April – the only one in 2023 so far – Floridians’ consumer outlook rose modestly again in May as the state bucks national trends.

Older adults either love Fla. weather or desire a full winter. The Census Bureau’s latest stats find that 18.7% of Floridians are aged 65 to 84 – but in Maine it’s 19.4%.

The Miami area led the nation in price gains with 14.1%, year-to-year, but of 8 Fla. metros included, even the lowest-ranking one (Tampa, No. 36) saw a 5.6% gain.

Transportation drives growth but transit growth also drives housing. Home values near a S. Fla. transit rail station are appreciating faster than those farther out.

The 2023 hurricane season starts June 1, and last year’s storms taught some lessons. For example, a focus on only cones and wind speeds leaves you vulnerable.

The Conference Board say inflation continues to drag down attitudes about the economy. However, job and income expectations through Oct. remain positive.

Optimize your RE website for search engines by integrating keyword phrases into content, metadata and titles – and also make sure your website is mobile-friendly.