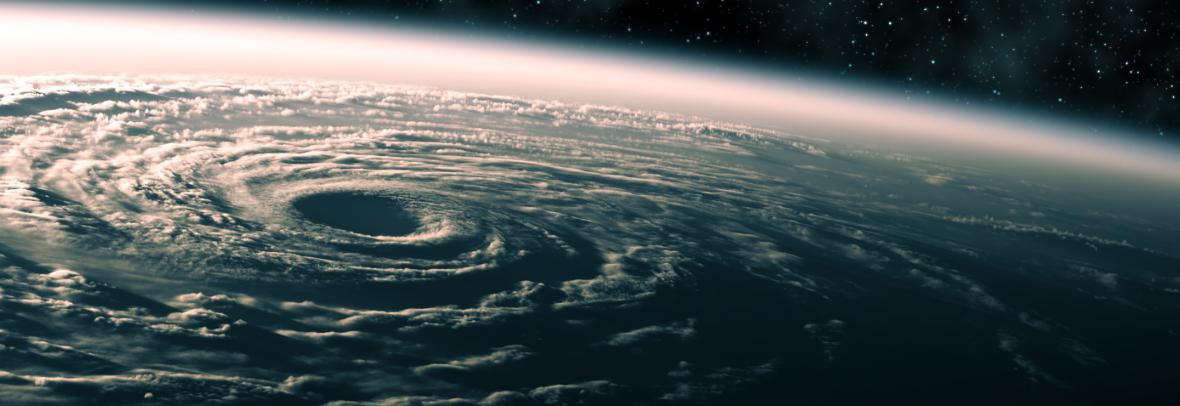

It’s Hurricane Season: Checked Your Insurance Policy?

The worst time to discover you have less insurance coverage than you thought? The day after a hurricane. The 2023 season starts today and runs through Nov. 30.

SEBRING, Fla. – June is here; that means sunscreen, bathing suits, sweet tea and yes, hurricane season.

Hurricane season starts June 1 and runs through Nov. 30.

In a previous interview, State Farm Public Affairs Specialist Jose Soto urged homeowners to take a look at their insurance policies before the season starts to ensure their coverage is up to date. Homeowners will want to know what their policies cover and don’t.

Sound drastic? Any Floridian who has been through a major hurricane such as Ian, Irma or Andrew can attest to the damage one storm can do. Floridians impacted by storms can attest to all manner of inconveniences from a power outage to needing a new roof.

Those on Florida’s west coast and as far inland as Hardee County can attest to the importance of home insurance after Hurricane Ian’s winds and waters destroyed homes last season. Ian’s destruction was so great, the name was retired forever.

Hurricane Ian was responsible directly or indirectly for more than 150 deaths. The Category 4 storm was the deadliest storm in 87 years. It caused $12 billion in damage, making it the costliest hurricane in Florida’s history and the third costliest in the United States, according to the National Oceanic and Atmospheric Administration.

While Highlands County doesn’t have to worry about storm surge, flooding is a different story. Many residents, especially those new to Florida, assume their homeowner’s policy covers water damage associated with hurricanes. However, only flood insurance covers floods, even if it was a result of the storm, NOAA said.

The National Flood Insurance Program stated one inch of water in a home can cause $25,000 worth of damage. Landlords may have flood insurance on their buildings but not on the inside contents of them. The renter’s belongings are their responsibility to insure.

“There is a 30-day waiting period when it comes to a flood policy,” Soto said. “Any new policy added to a home will have a 30-day waiting period. If the home was a new purchase, there would be no waiting period for flood insurance.”

Soto also said if a house was refinanced and a flood insurance policy was added, there would still be a 30-day waiting period.

Named storms or hurricanes will also affect home insurance purchases.

“Insurance companies won’t write homeowner policies when there is a named storm,” Soto said. “Once a storm has been named, that’s it.”

Many people may only be able to purchase flood insurance through the National Flood Insurance Program through the Federal Emergency Management Agency. For information on flood insurance, visit fema.gov/national-flood-insurance-program.

Renters should also check their insurance policy if they have one. Both homeowners and renters should take a digital inventory of their valuables. Pictures of receipts and serial numbers is an easy way to document high dollar items. Documenting valuables can help recover items if they are stolen too.

Keep the videos or lists of valuables, along with copies of the insurance policy in a fireproof/waterproof safe.

© Copyright © 2023, Highlands News-Sun, all rights reserved.