Rate Shopping Pays, Most Don’t Do It

Even small rate differences can expand the number of homes within reach for buyers facing strained affordability, new research shows.

SEATTLE – Home shoppers spend months searching for the right home, but most gather quotes from only one mortgage lender. That seemingly small decision can be a missed opportunity that costs buyers tens of thousands of dollars over the life of a loan, a new Zillow® analysis shows.

Home buyers typically invest months into the search process between hiring an agent, touring homes and making offers. Yet, when it comes to a mortgage, many buyers stop after the first quote, despite the huge financial stakes. Nearly 7 in 10 mortgage shoppers submit only one application, according to Zillow's Consumer Housing Trends Report.

"Buyers often spend months finding the right home, but only minutes comparing lenders," said Kara Ng, senior economist at Zillow Home Loans. "Even a small difference in rate can meaningfully shrink a monthly payment and expand the number of homes within reach. Affordability is tough enough today that buyers shouldn't overlook any potential savings."

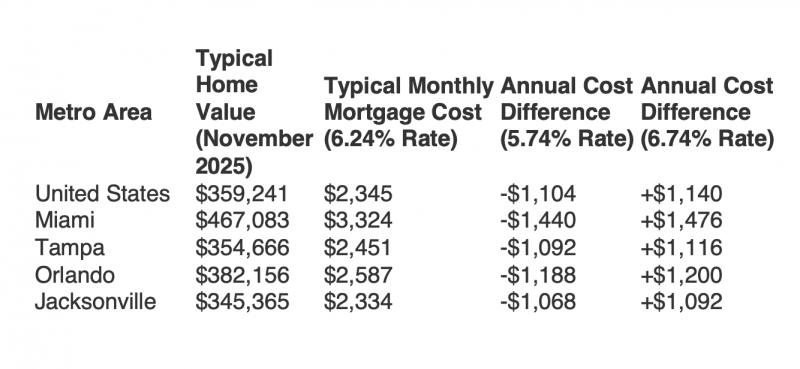

Zillow's analysis shows that on a typical U.S. home worth about $360,000, a buyer paying 6.24% — the average 30-year fixed rate in November — would owe about $2,345 each month. At 5.74% — within the typical range for shoppers who compare multiple offers — the payment drops to $2,253, saving roughly $1,100 a year. In November, that savings would have been enough to make 22,000 more homes nationwide affordable to a median-income household. These differences only grow in higher-cost markets.

Lenders weigh credit profiles, loan types and market conditions differently, meaning the same borrower can receive materially different offers. In a 2019 analysis, Zillow found spreads of from 90 to 130 basis points between the best and worst quotes for borrowers, depending on their credit profile. A more recent analysis from Freddie Mac showed home buyers can see rates move 50 basis points in either direction when receiving quotes from different lenders.

While affordability remains stretched for many prospective home buyers, it recently reached a three-year best, thanks in part to lower mortgage rates and record-high discounts from home sellers.

Source: Zillow

© 2025 Florida Realtors®