What’s ‘Special’ About Special Assessments?

Special assessments appear in various places of the Florida Realtors/Florida Bar contract, but Paragraph 3(c) on the Condo Rider has confused more than a few members.

ORLANDO, Fla. – The contracts and riders/addenda Florida Realtors offers members mention “special assessments” in various places. However, one tends to cause the most confusion: Paragraph 3(c) of the Florida Realtors/Florida Bar Condominium Rider (Condo Rider). This article focuses on that paragraph and how it operates.

Paragraph 3 of the Condo Rider is entitled “Fees, Assessments, Prorations and Litigation” and broken down into four subsections. The third section, subsection (c) covers “Special Assessments and Prorations.” A special assessment, in short, is a stand-alone charge above and beyond expected debt obligations, like a regular monthly payment.

Let’s take a look at 3(c) to hopefully make it easier to follow and, therefore, to complete and understand.

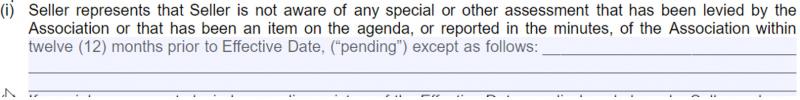

Subsection 3(c)(i) reads as follows:

Click image to enlarge

What exactly is supposed to go here? This section is where sellers inform buyers about any special or other assessments of the association.

Any special or other assessments? No, just those levied by the association OR been an item on the agenda OR reported in the minutes of the association.

Wait, for how long? Within twelve (12) months prior to the effective date of the sales contract. Many of the time calculations in the sales contracts involve the effective date, and this is just another example of why the date is vital for understanding contract calculations.

It’s important to note that this section covers levied AND pending assessments. Levied, as used here, is in the past tense and means an assessment that the association has charged or imposed. Pending is defined as any special assessment that has been an item on the agenda OR reported in the minutes of the association in the previous twelve (12) months.

Practical tip: Before completing this section, sellers should verify their information directly with the association. While sellers may be aware of a levied assessment, they might not be up to date on a pending one, given that pending assessments are assessments on the agenda or reported in the minutes for the previous twelve (12) months. This is especially true for sellers who may not primarily occupy the property.

As you will see later, skipping this step – not personally verifying pending assessment with the association prior to completing this section – could come back to haunt the seller.

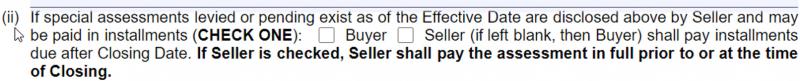

Let’s move on to subsection 3(c)(ii), which states:

Click image to enlarge

This section deals with levied or pending assessments that can be paid in installments. Many associations don’t require owners to pay an entire assessment amount upfront, but instead state that owners can pay the assessment in installments. Sellers should definitely check with the association to verify this information.

Once a seller has confirms that a levied or pending assessment may be paid in installments, this subsection clarifies who will pay the individual installments. While the seller pays any due before closing, the parties can choose who will pay installments due after closing by checking one of two boxes. The section may be left blank, but if it is, the buyer pays installments due after closing by default.

Note: If the box for Seller is checked, the seller pays the assessment in full prior to or at closing. Even if an assessment has an installment option, that option ends if the seller agrees to pay off any amounts due after closing. At this point, the seller stops using installments and pays off the full amount of the remaining debt obligation.

Subsection 3(c)(iii) says:

Click image to enlarge

Remember when I mentioned that a failure on the part of the seller to verify levied or pending assessments could come back to bite them? Well, here are the teeth.

To clarify, the seller’s failure to disclose levied or pending assessments existing as of the effective date results in the seller paying those undisclosed assessments in full at the time of closing. Sellers who filled out this paragraph off the top of their head – without doublechecking with the association – could end up with an extra unexpected cost. It’s important to tell your sellers to verify this information before they complete this document.

Practical tip: When taking any listing of property subject to an association, a prepared agent will let sellers know what information they need to get from the association. Give a copy of the applicable rider/addenda to sellers so they can review the questions and know what to ask. And start this process at the beginning, i.e. when taking the listing, not once sellers start getting offers.

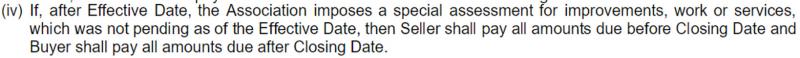

Subsection 3(c)(iv) discusses what happens if a special or other assessment is imposed after the effective date and states:

Click image to enlarge

This language emphasizes that any special assessment that is imposed after the effective date of the sales contract, which was not pending as of the effective date, will be broken down between the parties, with the seller paying all amounts due before closing and the buyer paying all amounts due after.

Note: This section says the imposed special assessment here was not pending, i.e. been on the agenda or reported in the minutes of the association in the previous twelve (12) months prior to the effective date. Again, knowing the effective date of the sales contract is important here! If the special assessment being imposed after the effective date was pending, then it should have been disclosed in subsection 3(c)(i).

Subsection 3(c)(v) clarifies exactly when an assessment is considered levied per paragraph 3.

Click image to enlarge

This section spells out that an assessment is deemed levied by an association on the date when the assessment has been approved, per Florida law and the condo documents buyer is entitled to receive under paragraph 5. This definition helps both the seller and buyer determine if/when an assessment has been levied.

And the last subsection of paragraph 3, subsection 3(c)(vi), discusses association assets and liabilities, such as reserve accounts, and clarifies that those items shall not be prorated.

Click image to enlarge

Prorations of many items are covered in the main body of the contract in paragraph 18(K), so this section of the Condo Rider makes it clear that the above items are not to be prorated.

As you can see, paragraph 3(c) covers a lot of information! Wise sellers will gather this information at the onset of the listing so they can accurately complete this (and other) sections of the Condo Rider. As noted, failure to verify the sellers’ personal knowledge on any applicable assessments could result in unhappy sellers who are faced with paying an assessment in full at closing. So while taking the time to confirm information with the association could be time consuming, it may save sellers a headache at closing.

Meredith Caruso is Associate General Counsel for Florida Realtors

Note: Information deemed accurate on date of publication

© 2023 Florida Realtors®