Impact of Interest Rates on Mortgage Payments

A swing in mortgage interest rates can translate into hundreds more per month and affect loan approvals. Use our graphic to help clients understand rate changes.

ORLANDO, Fla. – The Covid pandemic caused significant volatility in interest rates on 30-year fixed-rate mortgages. Before the pandemic, interest rates remained in the 3% to 5% range, which helped stabilize the housing industry and restore confidence in homeownership. Homeowners could sell their homes five to seven years later at rates similar to when they bought. The result was a stable market where the principal components of the loan were more important than the interest rates.

To prevent economic gridlock during the pandemic, the Federal Reserve reduced interest rates on the 10-year treasury to near zero, causing mortgage rates to fall quickly. This led to a hot market for buyers, who could take advantage of refinancing at lower rates, and higher home prices. Despite this, the monthly payment remained unaffected, and consumers could purchase properties of higher value with their increased purchasing power.

However, in mid-2022, interest rates started to rise rapidly, causing a significant change in the lending environment for those who bought or refinanced during the pandemic. A primary concern for potential homeowners is the monthly payment, which is often the largest expense in a household budget and affects the amount left for other expenses. A giant swing in interest rates on a mortgage could translate into hundreds of dollars, depending on the time of the transaction. The monthly payment also affects loan approval, as it must fall within stringent debt-to-income ratios to ensure a solvent buyer.

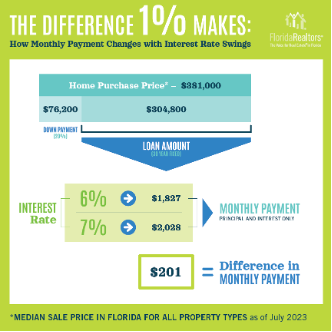

A one percentage point change

The infographic below provides a general visual representation of the impact of changes of one percentage point on monthly payments. While specifics depend on individual circumstances, the graphic demonstrates that a shift from 7% to 6% (which could happen if rates fall and the buyer qualifies to refinance) could reduce the payment by about $200. Waiting for rates to decrease, however, could backfire if rates continue to climb. What could have been secured at a lower rate could end up costing $200 more if rates increase.

The graphic is a valuable tool to help clients understand the general impact of rate fluctuations. Real estate professionals can use it to help clients understand the implications of rate changes and how they could affect their finances. Of course, Realtors® work out the specifics with clients based on the circumstances of their transaction.

Jennifer Warner is an economist and Director of Economic Development

© 2020 Florida Realtors®