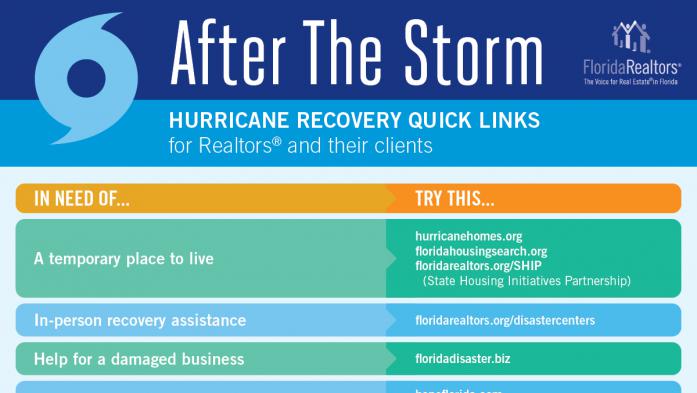

Hurricane Recovery Links for Realtors & Their Clients

Save, bookmark, pin or print this quick-reference list of organizations and programs ready to provide help after hurricanes.