Florida Realtors News

News Archive

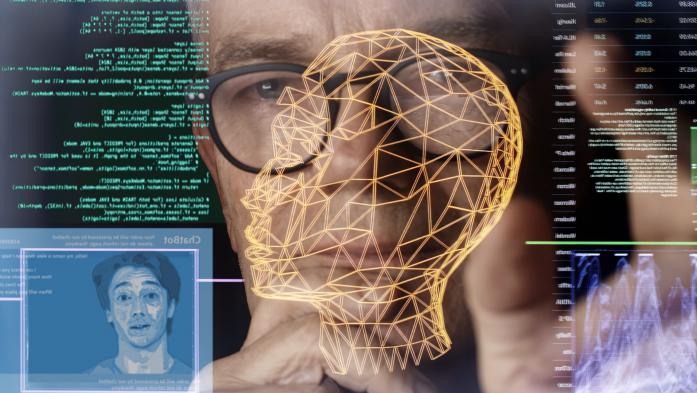

AI-powered search is reshaping how people find local services, and businesses without strong digital foundations risk losing visibility.

Experts say budgeting for maintenance, energy upgrades and taxes can help homeowners manage rising housing costs.

The association emphasizes that brokers and agents who choose to participate in an MLS agree to comply with the policies and rules.

Using retirement savings can help buyers cover a down payment, but experts say borrowers should consider the long-term financial tradeoffs first.

Mortgage rates rose this week as Middle East tensions pushed oil prices higher, while a weaker jobs report added new uncertainty to the economic outlook.

From spa-inspired bathrooms to smart lighting and flexible spaces, the home improvements gaining traction in 2026 blend comfort, efficiency and design.

Florida’s five largest auto insurers are indicating an average 8% rate drop for 2026. Regulators say improving market conditions could bring relief to some drivers.

Most seniors want to stay in their homes as they age, but many doubt it will happen. The trend shapes housing supply, renovation demand and multigenerational living.

Property managers and contractors working in pre-1978 homes may need EPA certification. Recent guidance clarifies who can be held liable.

Associations can fine owners for violations, but the rules must be specific. A vague maintenance clause may not support penalties for a “dirty” roof.