VA Loan Helps Veterans Buy Homes 4.4 Years Sooner

Underutilization of VA loans delays homeownership, especially in high-cost markets and areas where veterans may not know about their benefits, new research shows.

AUSTIN, Texas — For many U.S. veterans, buying a home can feel out of reach, but a 0% down Veterans Affairs home loan can help first-time buyers move in 4.4 years sooner than with a typical conventional loan, according to a new report from Realtor.com and the National Association of Realtors®.

A custom analysis of NAR's 2024 Profile of Home Buyers and Sellers finds that 74% of first-time VA loan users put 0% down, compared with a 12% median down payment for conventional first-time buyers. With a VA loan, borrowers only need to cover standard closing costs, which are similar for both types of loans. On a typical $430,000 home, a conventional buyer would need roughly $51,600 upfront that a VA loan buyer wouldn't need. For a first-time buyer saving 15% of a median $78,700 annual gross income, it would take about 4.4 years to accumulate that amount.

A lower 10% savings rate stretches the timeline to 6.6 years, while a more aggressive 20% rate shortens it to 3.3 years. In short, a 0% down VA loan lets buyers enter the market and start building equity years sooner.

"For many veterans and service members, a VA loan can be a game changer," said Danielle Hale, chief economist at Realtor.com. "By removing the hurdle of a large down payment, these loans open doors to homeownership and financial security years sooner."

Across U.S., VA loans unlock homeownership 2.7 to 10 years sooner

Across U.S. metro areas, VA loans give first-time buyers a head start, cutting years off the path to a home. Assuming the same 0% down payment for VA loans versus 12% for conventional loans, and a 15% household saving rate for first-time buyers making the local median income and purchasing a home at the local median price, these loans can help buyers get a foothold in their local market years sooner. On the lower end, a VA loan lets buyers reach homeownership 2.7 years sooner than a conventional loan in Akron, Ohio, and 2.8 years sooner in Dayton, Ohio, while in higher-cost areas, it ranges from 6.5 years sooner in New York City, 7.5 years in both San Diego and Oxnard–Thousand Oaks, Calif., and up to 10 years sooner in Los Angeles.

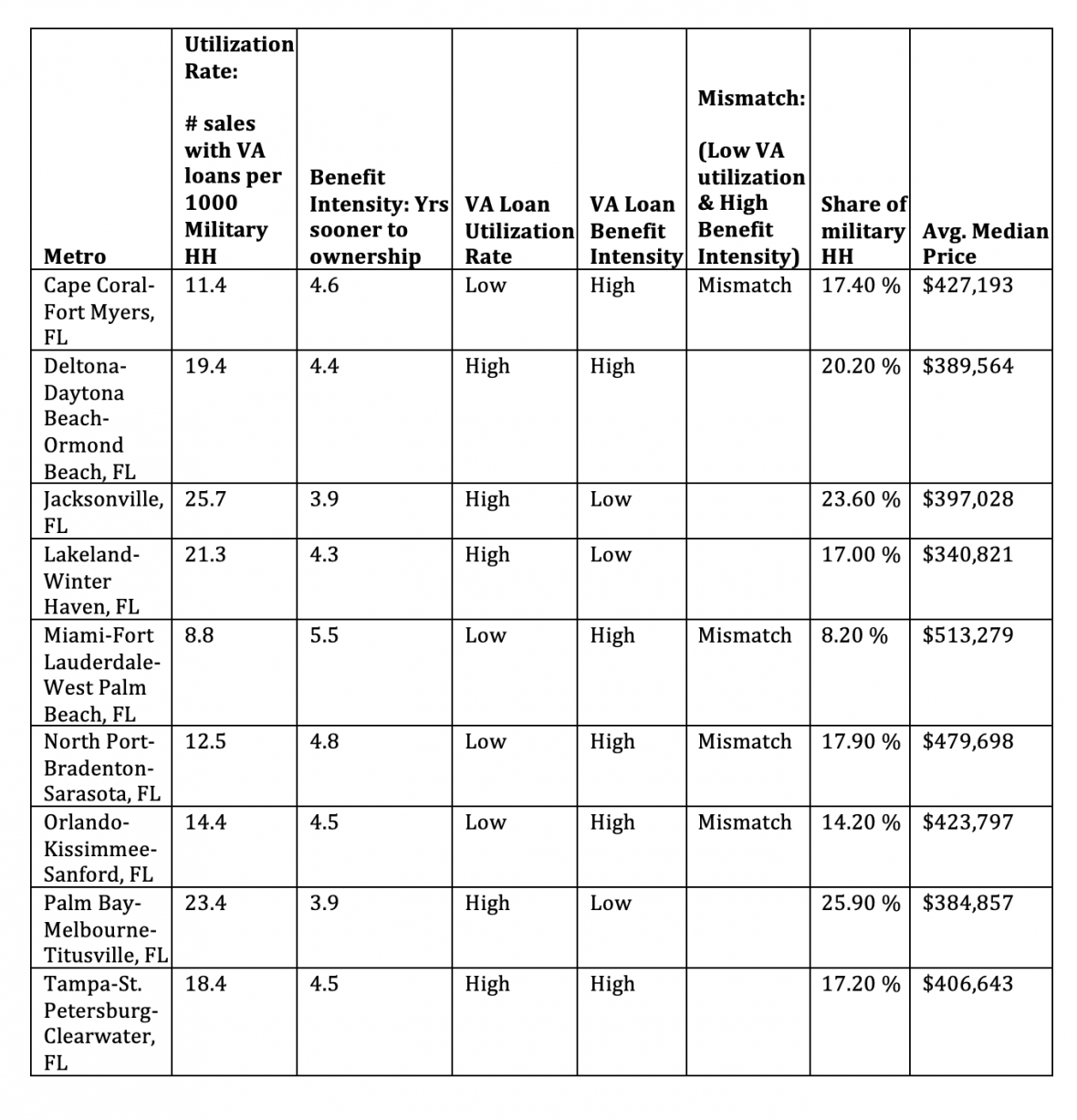

High-cost, co-op heavy markets lag in VA loan use; military hubs lead the way

Despite the clear advantages of VA loans, use remains low in some areas – especially high-priced metros like Los Angeles, San Francisco, San Jose and New York, where home prices, co-op restrictions, and limited awareness all play a role.

"The VA Home Loan program has opened the door to homeownership for more than 48 million veterans and service members – one of the most successful housing initiatives in American history," said Lawrence Yun, NAR chief economist. "The standout benefit of a VA loan is the 0% down payment but without the extra risk. The lower upfront cost makes homeownership more attainable, especially in high-cost markets and amid elevated mortgage rates, giving qualified buyers a critical advantage and the ability to start building equity sooner. The VA Home Loan program is a shining example of how smart federal policy can expand access to homeownership, strengthen communities, and reward those who've served our nation."

In metros with a high concentration of co-ops, like New York, additional barriers limit access to VA loans, resulting in one of the nation's lowest utilization rates – just 3.8 VA-financed home sales per 1,000 military households. That's because in addition to high-costs, VA loans cannot currently be used to purchase co-ops, and condos or townhomes must be VA-approved to qualify. Identifying and addressing these underutilized markets is key, as many are exactly where Veterans could benefit most from the 0% down payment advantage.

Conversely, metros near major military bases – including Virginia Beach, Va. and Colorado Springs, Colo. – show some of the highest VA loan utilization rates, 42.1 and 43.1, respectively, reflecting both the concentration of military households and stronger awareness of the program. In contrast, markets like Salt Lake City and Fresno, Calif., have fewer military households, which may contribute to lower awareness despite the potential for significant financial benefit.

Closing the awareness gap to help more veterans achieve homeownership

Despite VA loans' many advantages, only about one-third of veterans and active-duty service members know they can buy a home with no money down, according to a 2025 survey from Veterans United Home Loans.

"Many veterans don't realize that a VA loan removes the need for a down payment, which is one of the biggest hurdles to homeownership," said Chris Birk, vice president of Mortgage Insight and Education, Veterans United Home Loans. "As the nation's largest VA lender, we see every day how this benefit changes lives. When Veterans understand the power of their VA loan, they can start building equity and stability for their families years sooner."

Source: Realtor.com

© 2025 Florida Realtors®